What is IR35?

IR35 is a piece of government legislation created to help distinguish genuinely independent contractors from those who are essentially disguised employees, working full time via their PSC to gain tax advantages.

It’s only the changes implemented in 2021 that have brought IR35 to the forefront of both business and contractor considerations; whereas the legislation was first introduced by HMRC in 2000.

So, what are those changes?

From April 2021, Private Sector hirers are responsible for assessing a contractor’s IR35 status. This responsibility previously sat with the Contractor.

When IR35 was first introduced in 2000, contractor’s themselves were responsible for self-assessment. The regulations were changed in 2017, to make Public Sector hirers responsible for assessing contractors instead. Private Sectors hirers now join them, providing every contractor with a Status Determination Statement (SDS) that clearly states their employment status under IR35.

The 2021 changes apply to medium and large business that meet two or more of the following criteria:

- a turnover of more than £10.2m;

- a balance sheet total of more than £5.1m;

- 50 employees or more.

What are the risks facing our clients?

The building services industry has always had an abundance of contractors. They are essential to the smooth delivery of projects and many businesses would be lost without them.

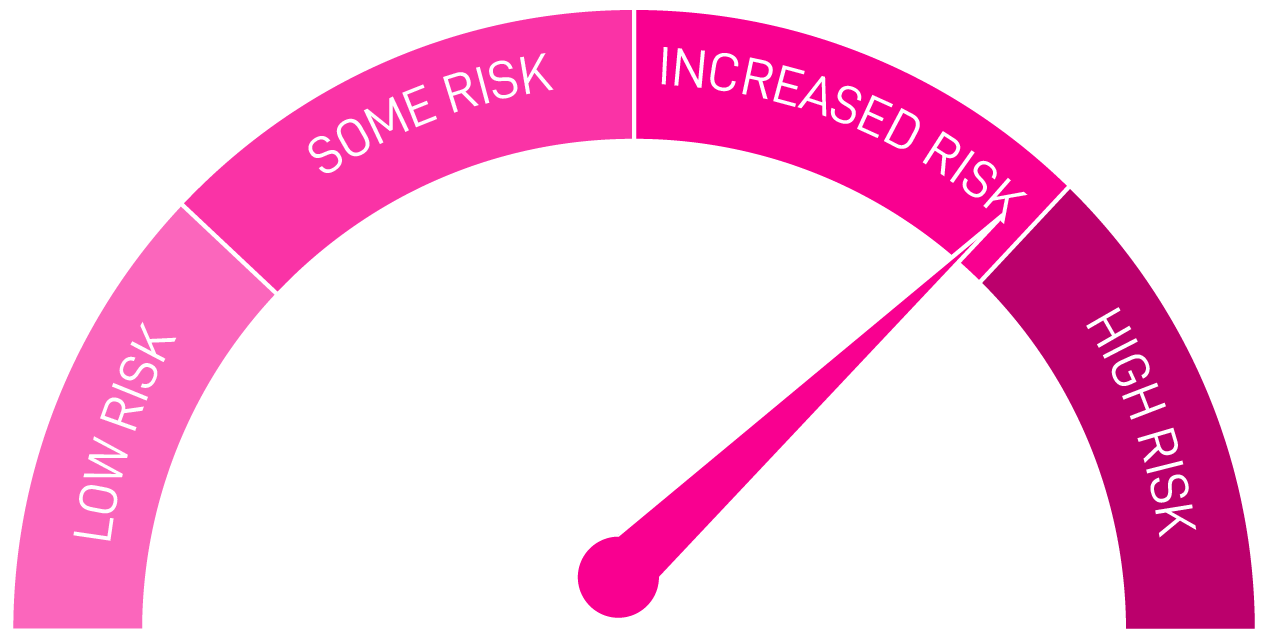

End clients could be left open to financial risk if their contractors are found to be incorrectly determined. As you, the end client, will be responsible for determining whether a contractor is ‘inside’ or ‘outside’ scope you must ensure you are making correct assessments.

FINANCIAL RISK

If HMRC finds contractors to have incorrect determinations then the end client will face potential tax / National Insurance losses.

For example: For a contractor on £100k the tax / National Insurance would be circa £20k. Therefore, for a contractor on a salary of £100k who is found to have been incorrectly determined, the end client would face a bill of £80k plus interest and penalties/fines over 4 years.

LEGAL, REPUTATIONAL AND OPERATIONAL RISK

Outside of financial risk, operational, legal and reputational damage can arise if businesses have not prepared for change appropriately or early enough.

Delay to projects due to loss of resource, litigation with HMRC and a restriction to the flow of contract talent are all risks that may arise.

DON'T PANIC

How to mitigate your IR35 exposure

You need to take action now in order to mitigate the risks above and become compliant. There’s no middle ground - you’re either compliant or you’re not.

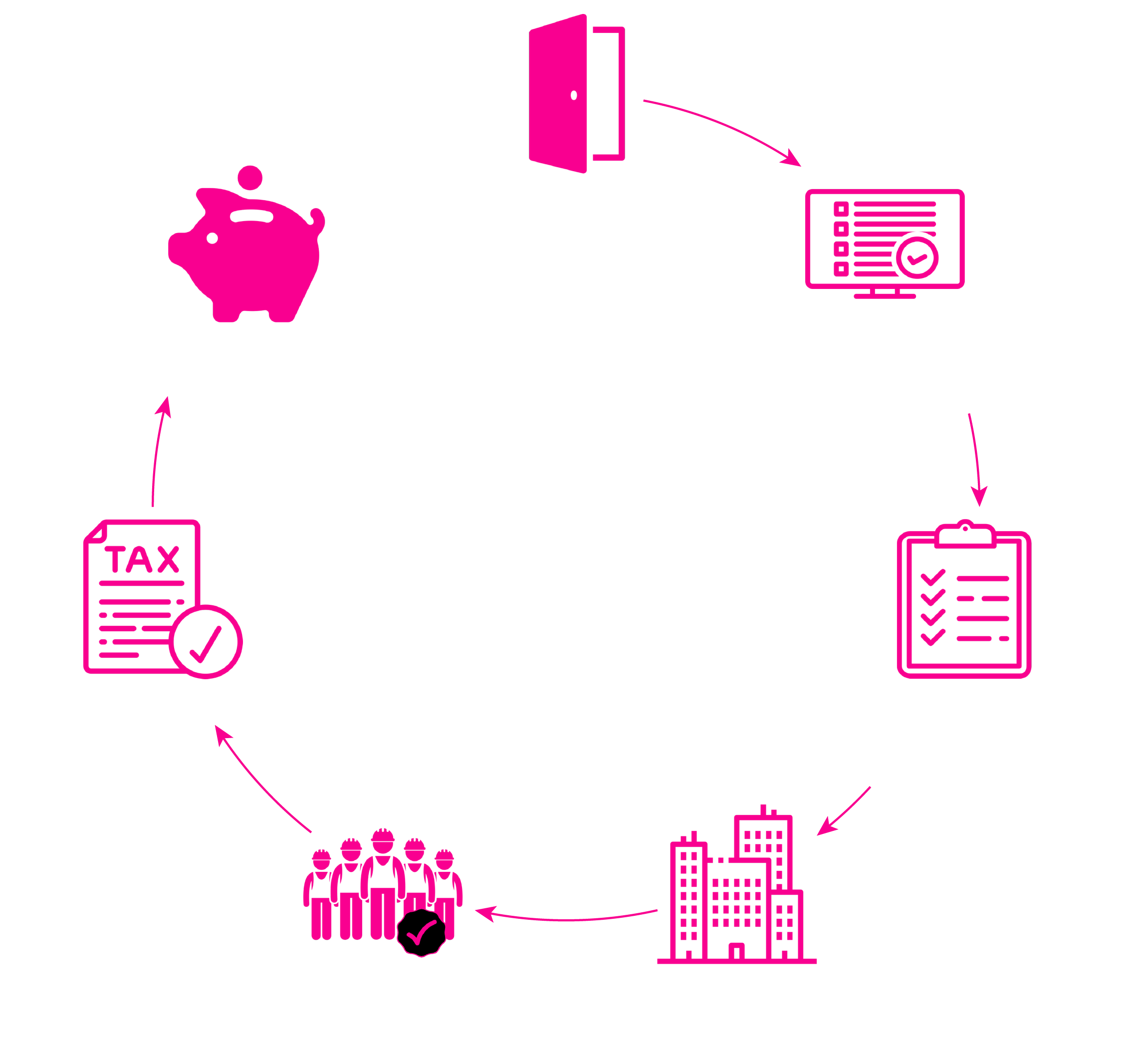

The first step in ensuring compliance is making your determinations- i.e. assessing whether a particular contract assignment falls inside or outside of the off-payroll worker rules. As you may well have experienced already, assessing IR35 status isn’t always easy as there are a number of influencing factors.

If you’re considering reviewing or changing your existing practices to ensure they are consistent with an outside IR35 determination, you may wish to consider the following changes to your working practices with contractors:

Personal Service

The worker is required to provide their own work or skill in performing the work

Mutuality of Obligation

The client is obliged to offer the contractor work and the worker is obliged to perform it for pay

Control

The client has the right to decide how, when and where the work will be done

Integration

The worker is integrated into the client’s business operation

Business Dependency

Where possible, you should take steps to help ensure that the contractor is not solely dependent on your business for its income

We will insure you against potential IR35 disputes

Our partnership with Kingsbridge means that we cover the cost of insurance for our contractors against any potential IR35 disputes.

For businesses, this means you can have a fully compliant, insured and talented workforce via Greystone. Your projects can continue fully staffed, we take on the responsibility and risk, you can save time on IR35 administration and save £1000s in legal advice - it’s all part of the package